Introduction

The cryptocurrency market remains one of the most dynamic and rapidly evolving financial ecosystems. Among the myriad digital assets, Solana, Ethereum, and Bitcoin continue to dominate both investor interest and market capitalization. As traders and investors seek to navigate this volatile landscape, accurate price predictions for these leading cryptocurrencies become crucial tools for strategic decision-making.

In this article, we delve deep into recent price predictions and analysis for Solana, Ethereum, and Bitcoin, exploring market factors driving their value movements, supported by data-driven insights. Understanding these trends is essential for anyone looking to capitalize on or mitigate risks in the current crypto environment.

Market Context and Background

Bitcoin, the pioneer cryptocurrency, still holds the largest market share and acts as a bellwether for the entire crypto ecosystem. Ethereum’s innovative smart contract platform fuels decentralized finance (DeFi) and non-fungible token (NFT) sectors, significantly influencing its valuation. Solana, emerging as a high-speed, low-fee blockchain, has gained substantial attention as a viable alternative to Ethereum.

Recent market conditions have been marked by heightened regulatory scrutiny, variable inflation rates, and geopolitical tensions, all impacting crypto asset prices. Institutional adoption, technological upgrades, and evolving investor sentiment continue to shape the landscape for these three tokens.

Data-Driven Insights

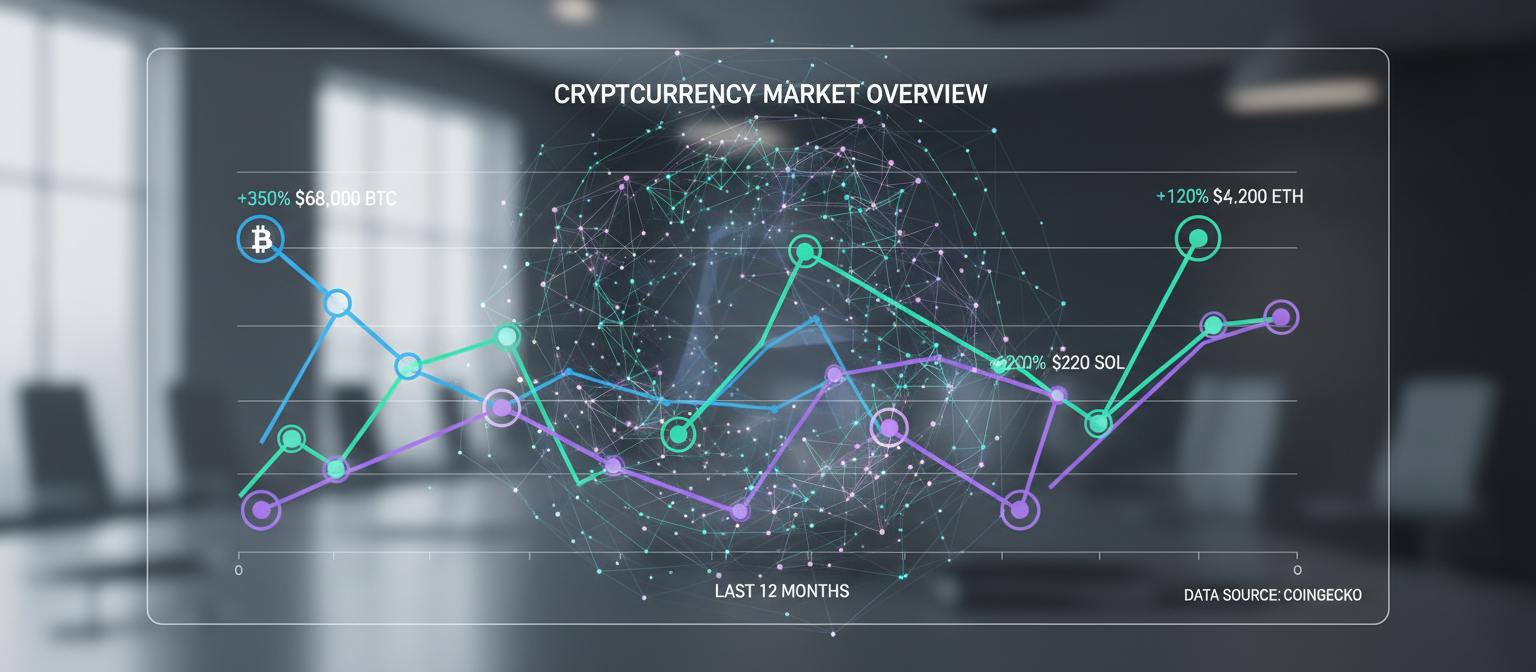

Analyzing recent price trends, Bitcoin has demonstrated resilience above its key support levels, with on-chain metrics indicating accumulation phases by large holders. Ethereum’s upcoming network enhancements and growing DeFi activity are factored into bullish forecast models, predicting moderate to strong appreciation potential.

Solana’s network performance and rapid transaction speeds have contributed to its rising demand; however, intermittent outages and network issues have prompted cautious sentiment among investors. Market data sourced from trading volumes, volatility indices, and technical indicators offers a comprehensive perspective on short- and medium-term price trajectories for these assets.

Risks and Opportunities

Risks:

- Regulatory crackdowns globally may constrain market liquidity and induce volatility.

- Technological challenges, such as Ethereum’s transition risks and Solana’s network stability, could impact investor confidence.

- Market sentiment remains fragile, with macroeconomic uncertainties influencing crypto adoption rates.

Opportunities:

- The sustained interest from institutional investors is likely to enhance market depth and stability.

- Advancements in blockchain technology and scalability solutions may propel asset value growth.

- Decentralized financial ecosystems and NFT markets continue to offer innovative use cases driving demand for these cryptocurrencies.

Future Outlook and Predictions

Looking ahead, Bitcoin is expected to maintain a leadership position, potentially testing new all-time highs if adoption and macro conditions improve. Ethereum’s network upgrades, notably its shift to proof-of-stake consensus, are anticipated to reduce energy consumption and increase throughput, bolstering its fundamental value proposition.

Solana’s future hinges on overcoming network reliability concerns but holds promise due to its speed and developer ecosystem expansion. Continued innovation and integration within DeFi and NFT spaces will be pivotal in defining the trajectories of these cryptocurrencies.

Conclusion

Price predictions for Solana, Ethereum, and Bitcoin reflect a complex interplay of technological evolution, market dynamics, and regulatory developments. While opportunities abound, inherent risks necessitate a balanced approach to investment and trading strategies. Staying informed through data-driven analysis and monitoring market signals remains essential for crypto market participants aiming to optimize outcomes.

Leave a Reply