Introduction

Solana (SOL) has been capturing the attention of crypto investors and analysts alike amid its ambitious technology advancements and market movements. As we move further into 2026, understanding Solana’s price trajectory has become a key focus for traders looking to capitalize on altcoin gains. This article offers an in-depth look at Solana’s recent price predictions and the market factors influencing its future.

Despite a volatile crypto landscape, Solana continues to maintain strong investor interest due to its high throughput and the growing decentralized application ecosystem it supports.

Market Context and Background

Launched as a high-speed blockchain platform, Solana aims to deliver scalable decentralized solutions with low transaction costs. Its unique proof-of-history consensus mechanism sets it apart from Ethereum and Bitcoin. After experiencing rapid growth in 2021 followed by market-wide corrections, Solana is now entering a phase where technology upgrades and network adoption will dictate its market position.

Recent months have seen renewed optimism toward Solana, as developers push updates to improve network stability and scalability. This backdrop is essential to framing the price predictions emerging from analysts focused on Solana’s medium- and long-term performance.

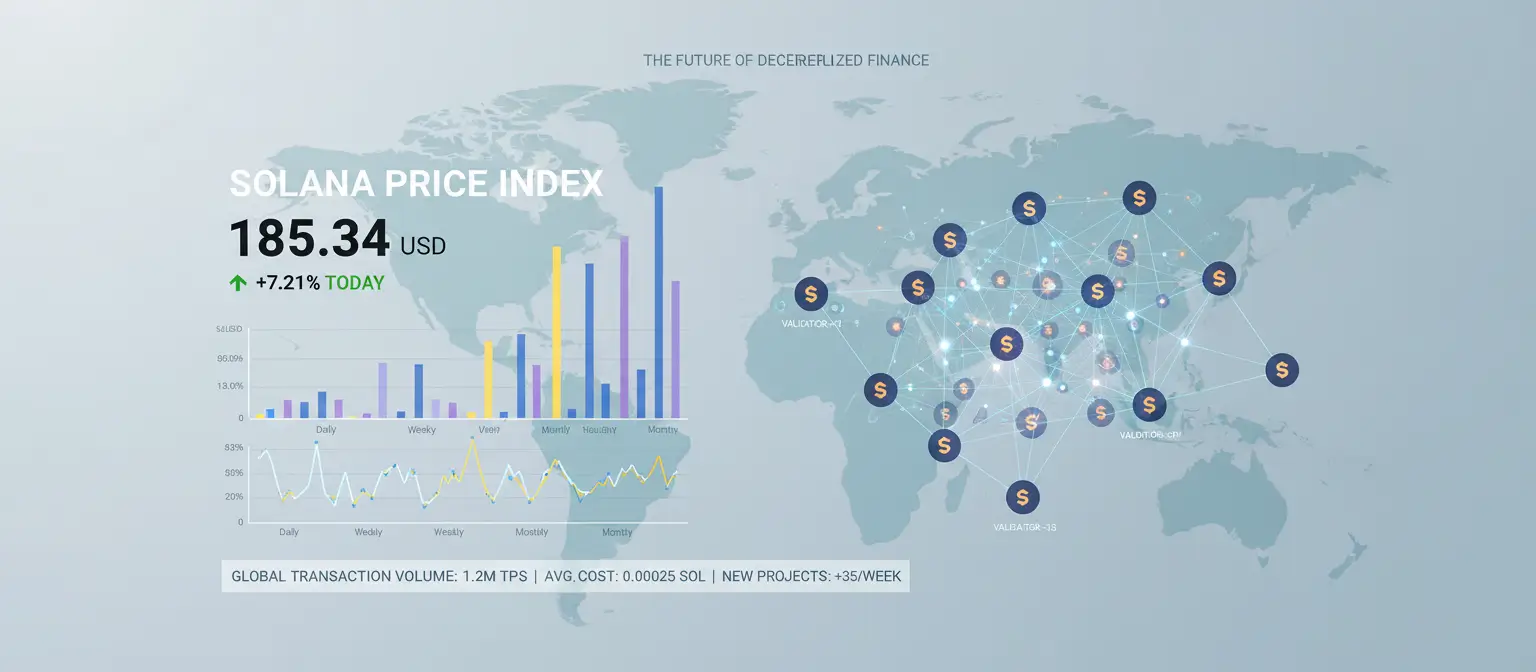

Data-Driven Insights

Technical analysts have employed various models to forecast Solana’s price range for 2026. Based on on-chain activity, transaction volumes, and historical price patterns, many predictions suggest a bullish trend continuing into Q2 and Q3. For instance, some chart analyses point to potential price resistance levels around $75–$85, with support zones stabilizing above $40.

Fundamental metrics also contribute to these forecasts. Increasing developer engagement, partnership announcements, and network usage indicators imply growing intrinsic value. However, macroeconomic factors such as Bitcoin price trends and regulatory signals will also weigh heavily on Solana’s market performance.

Risks and Opportunities

Risks:

- Network outages or technical failures could undermine investor confidence.

- Heightened regulatory scrutiny on altcoins may impact market liquidity and adoption.

- Competition from rival layer-1 blockchains with aggressive growth strategies.

Opportunities:

- Ongoing protocol upgrades aiming to enhance scalability and reduce fees.

- Expansion of DeFi, NFT, and gaming ecosystems on Solana attracting larger user bases.

- Potential institutional interest as blockchain adoption broadens globally.

Future Outlook and Predictions

Looking forward to the remainder of 2026, Solana’s trajectory is cautiously optimistic. If development milestones are met and network stability improves, price consolidation in the $70–$90 range could materialize. Conversely, macro conditions and competitive pressures might temper gains.

Experts also suggest monitoring upcoming Solana ecosystem projects and regulatory developments, as these will be pivotal in shaping investor sentiment. The interplay of technological innovation and market dynamics will likely define Solana’s long-term success.

Conclusion

Solana’s price predictions for 2026 highlight a promising yet complex future. Investors must weigh both technical and fundamental indicators while remaining aware of external market forces. With its strong developer community and unique blockchain solutions, Solana stands as a major altcoin contender poised for growth, but careful consideration of risks is essential for strategic decision-making.

Leave a Reply