Introduction

Solana (SOL), once known primarily as a meme-coin hub, is undergoing a remarkable transformation that has captured the attention of investors and crypto enthusiasts worldwide. Standard Chartered has recently issued a bold prediction for Solana’s price, forecasting a surge to $200 by 2026 and a staggering $2,000 by 2030. This forecast is driven not merely by hype but by Solana’s positioned ascent as the fastest-growing stablecoin network, even outpacing Ethereum in transaction volume and velocity.

The crypto market is notoriously volatile, yet Solana’s recent performance — including steady weekly gains despite general market dips — signals a potential paradigm shift. This article delves into the data, market context, and expert predictions fueling the bullish sentiment around Solana, assessing whether these lofty targets are within reach.

Market Context and Background

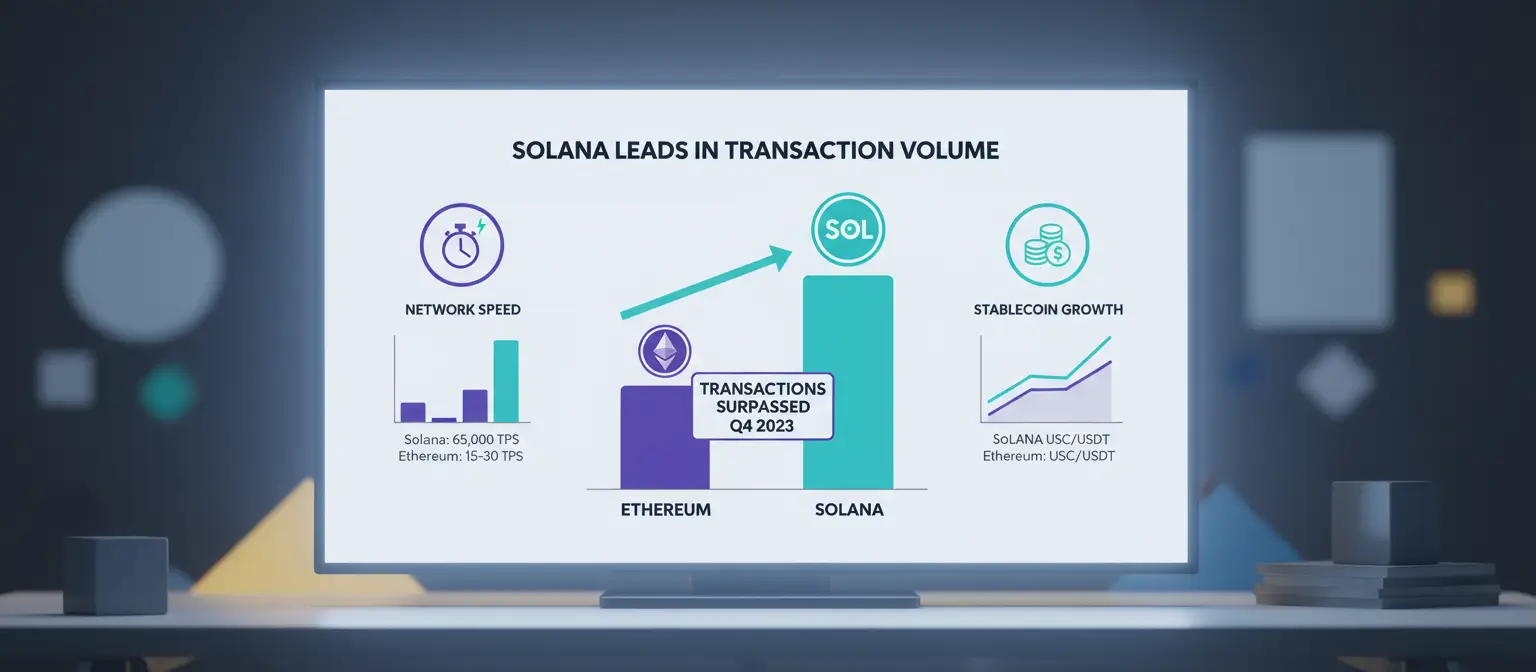

Solana’s journey from a speculative meme coin to a major infrastructure player stems from its unique blockchain technology optimized for speed and cheap transactions. In early 2026, Solana overtook Ethereum as the largest stablecoin network by transaction volume and speed, a feat that underscores its growing utility in decentralized finance (DeFi) and payments.

Several factors contribute to this rise: Solana’s network boasts up to 65,000 transactions per second (TPS) with finality of about 400 milliseconds, making it one of the fastest blockchains available. Additionally, Solana’s low transaction fees have attracted developers and stablecoin projects, driving rapid adoption. As a result, the network has become a go-to platform for stablecoins, which are critical for liquidity and trading in crypto ecosystems.

Data-Driven Insights

Standard Chartered’s forecast of Solana hitting $200 by 2026 and $2,000 by 2030 is based on key growth indicators. Firstly, Solana’s transaction volume and velocity metrics have eclipsed those of Ethereum, a market leader. Weekly gains of around 0.89% against bearish market trends highlight resilience and underlying demand.

Expert price targets from platforms like Wallet Investor and DigitalCoinPrice reinforce this bullish outlook, with projections ranging from $325 to over $1,500 within the next five years. Wallet Investor attributes these gains to Solana’s scalability and expanding decentralized application (dApp) ecosystem, while DigitalCoinPrice highlights the potential of increased stablecoin adoption fueling price appreciation.

On-Chain Metrics

- Transaction Volume: Solana leads in stablecoin transactions, outpacing Ethereum by a significant margin as of early 2026.

- Network Velocity: The speed at which assets circulate on Solana is higher than Ethereum’s, signaling increased liquidity and trading activity.

- Weekly Price Stability: Despite volatile market conditions, Solana posted a steady weekly growth of approximately 0.89%, defying typical bearish sentiment.

Technical Analysis

While Solana has faced bearish patterns recently, such as head-and-shoulders formations that suggest potential dips to $50, these are offset by the strong underlying fundamentals driven by stablecoin network adoption. The coin’s current trading price around $78, which is a 73% discount from its all-time high of $294, presents a value proposition for long-term investors.

Risks and Opportunities

Every investment carries risks, and Solana is no exception. Market-wide selloffs and crypto cyclical downturns remain threats that could suppress price momentum. Technical bearish signals and overall market correlation with Bitcoin’s performance mean a clearance below $50 cannot be disregarded.

Conversely, Solana’s pivot toward stablecoins and DeFi projects represents a significant opportunity. The network’s rapidly growing transaction volume and velocity may attract more institutional investors and developers, potentially driving the price beyond current predictions. The scalability and low-cost transactions give Solana an edge in catering to emerging use cases, making it a strong candidate for market leadership in the coming years.

Future Outlook and Predictions

Looking ahead to 2026 and beyond, Solana’s trajectory depends heavily on continued adoption and technological development. If the network maintains its position as the stablecoin transaction leader, the $200 price target in 2026 appears achievable. Beyond that, the potential for a $2,000 price by 2030 aligns with forecasts from financial institutions who emphasize the transformative impact of decentralized finance and blockchain integration into the global economy.

Key drivers to watch include Solana’s network upgrades, partnerships, and ecosystem expansion, as well as broader market sentiment and regulatory developments. Should these factors align favorably, Solana’s explosive growth could redefine expectations for blockchain asset valuations in the next decade.

Conclusion

Solana’s evolution from a niche meme coin to a mainstream stablecoin powerhouse epitomizes the dynamic nature of the cryptocurrency space. Standard Chartered’s price predictions are ambitious but grounded in solid on-chain metrics and market fundamentals, offering a compelling case for investors to consider Solana a major growth opportunity.

While risks exist, the data-driven insights and expert forecasts suggest that 2026 and the coming years could mark Solana’s rise as one of the most valuable crypto assets. Investors seeking exposure to scalable, fast, and cost-effective blockchain networks may find in Solana a uniquely positioned contender to watch closely.

Leave a Reply