Introduction

In early 2026, Solana has emerged as a major player in the cryptocurrency landscape, dramatically transforming its position from a meme coin favorite to a burgeoning stablecoin powerhouse. This transition underscores a fundamental shift in the blockchain’s utility and market perception, driven by rapid transaction volume growth and increasing velocity in stablecoin transactions. Industry heavyweights like Standard Chartered have taken notice, forecasting an explosive potential rally, with price predictions soaring as high as $2,000 by 2030.

For traders and investors alike, understanding the dynamics behind Solana’s stablecoin surge is critical in navigating the increasingly competitive blockchain ecosystem. This article delves into the market context, provides data-driven insight, evaluates risks and opportunities, and offers a future outlook on Solana’s evolving role.

Market Context and Background

Solana’s blockchain has historically been known for its high throughput and low fees, making it a friendly environment for decentralized applications (dApps) and meme projects alike. However, Ethereum long held dominance in the stablecoin sector. Early 2026 marked a fascinating turning point as Solana overtook Ethereum as the fastest-growing blockchain in terms of stablecoin transaction volume and velocity. This shift is particularly significant in light of Ethereum’s congestion issues and escalating gas fees, which have created openings for competitors.

Stablecoins, valued for their price stability and use as payment rails, are pivotal in the crypto payment and DeFi ecosystems. Solana’s faster processing times (sub-second transaction finality) and drastically lower fees have made it a preferred network for high-frequency stablecoin transactions — especially micro-payments, remittances, and decentralized finance operations.

Key Drivers Behind the Surge

- Transaction Efficiency: Solana processes over 50,000 transactions per second, significantly surpassing Ethereum’s capacity, enabling seamless stablecoin transfers.

- Cost Effectiveness: Lower fees incentivize stablecoin issuers and users to migrate or adopt Solana-based stablecoins.

- Developer and Institutional Adoption: Enhanced tooling, partnerships, and nodal decentralization have piqued institutional interest.

- Macroeconomic Influences: Growing demand for stable digital assets amid global currency volatility supports stablecoin growth on efficient networks.

Data-Driven Insights

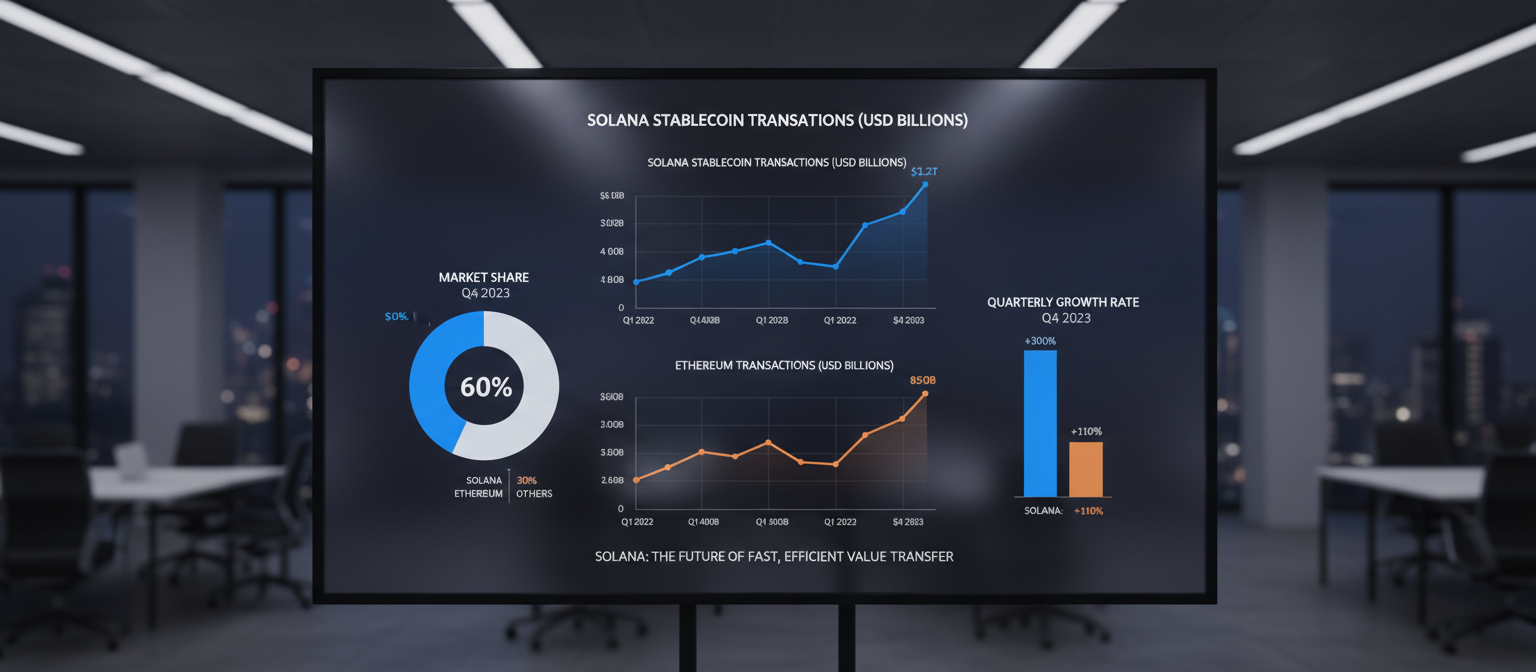

Quantitative metrics solidify Solana’s rise as a stablecoin platform. According to early 2026 reports:

- Solana’s stablecoin transaction volume surpassed Ethereum by approximately 15%, signaling shifting user preferences.

- Transaction velocity—the speed at which stablecoins circulate—on Solana grew by over 120% year-to-date, compared to Ethereum’s modest 35% growth.

- New stablecoin issuances on Solana-based protocols increased by 40%, indicating developer confidence.

Moreover, the market is responding to these fundamentals. Solana’s price, despite enduring bearish sentiment with a 73% discount from its all-time high, has shown resilience. Some models suggest a consolidation phase could precede a significant rally, fueled by increased stablecoin adoption and macro-trend tailwinds.

Risks and Opportunities

While the stablecoin surge on Solana presents considerable opportunities, it is not without risks:

- Network Centralization Concerns: Critics point to validators’ concentration as a potential threat to long-term decentralization and security.

- Regulatory Scrutiny: Increased focus on stablecoins globally may lead to tighter regulations affecting issuers and networks.

- Market Volatility: Despite stablecoin stability, Solana’s native token price is subject to volatile swings driven by speculative trading and broader market cycles.

On the opportunity side:

- Payment System Integration: If Solana captures more micro-payment and remittance use cases, its stablecoin ecosystem could experience exponential growth.

- DeFi Expansion: The growing DeFi infrastructure on Solana creates fertile ground for innovative financial products and yield opportunities centered around stablecoins.

- Institutional Adoption: Continued partnerships with banks and payment providers, like those hinted by Standard Chartered’s forecasts, could accelerate network effects.

Future Outlook

Analysts at Standard Chartered have made a bold prediction that Solana’s token could reach $200 in 2026, escalating to an astonishing $2,000 by 2030, largely driven by its stablecoin network effect and scalability merits. This forecast assumes sustained growth in transaction volume, developer engagement, and regulatory clarity supporting stablecoin proliferation.

Furthermore, Solana’s role as a micro-payment infrastructure could position it as a crucial player in the global digital payments revolution, especially in emerging markets. If it can maintain its technological advantages and address decentralization concerns, the blockchain may consolidate its status as a payment powerhouse, challenging Ethereum’s decades-long dominance.

Conclusion

Solana’s surge in stablecoin usage is more than a fleeting trend—it represents a strategic evolution in blockchain adoption with significant implications for traders, investors, and developers. By leveraging high throughput, low fees, and an expanding stablecoin ecosystem, Solana is carving out a sustainable competitive advantage in an otherwise saturated market.

However, potential investors and traders should weigh inherent risks including regulatory uncertainties and network centralization against promising growth trajectories. With careful due diligence and strategic positioning, participants can harness the opportunities that Solana’s stablecoin rise offers during this transformative period.

Leave a Reply