Introduction

Ethereum has maintained a commanding presence in the cryptocurrency market despite periods of broad sell-offs. As of February 2026, its sustained momentum is largely attributed to the rapid adoption of Layer-2 scaling solutions and sustained DeFi activity. This article delves into why Ethereum continues to hold robust institutional and retail interest, analyzing recent network upgrades, trading volumes, and ecosystem growth.

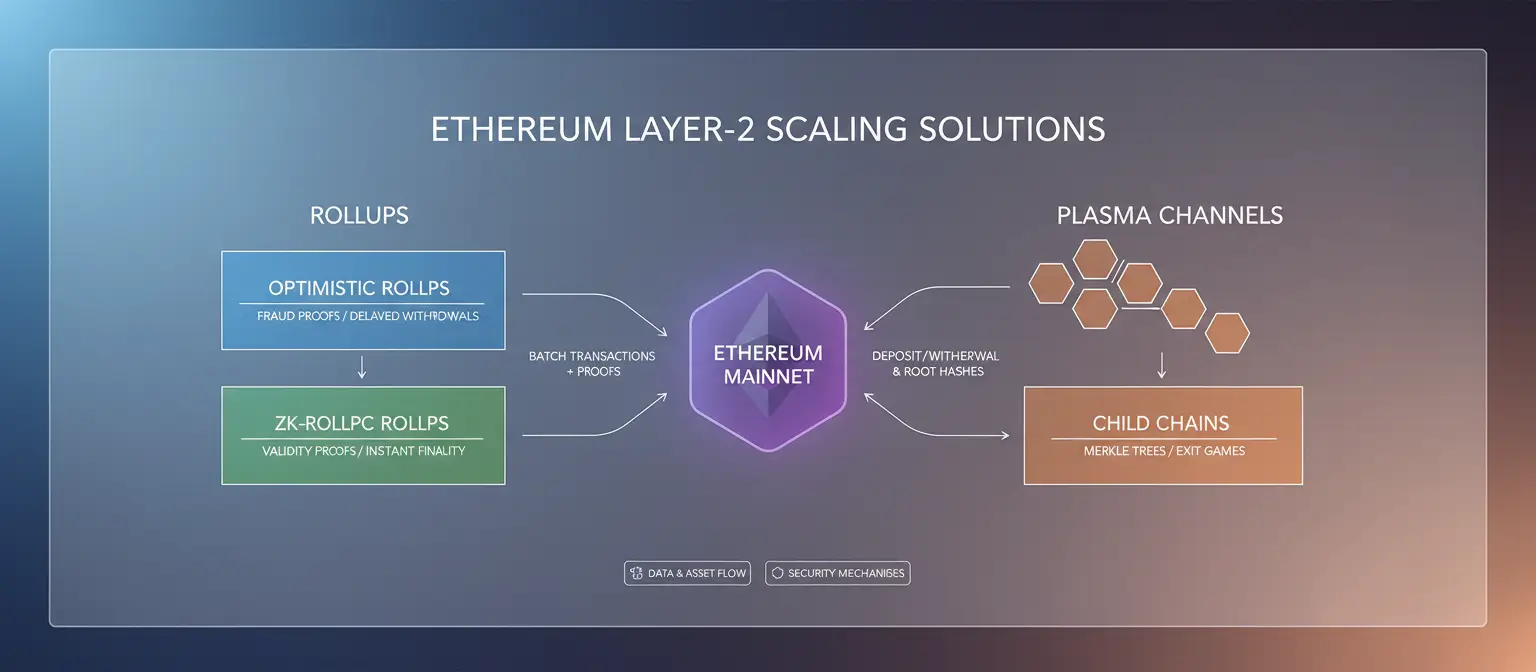

The Layer-2 ecosystem built on Ethereum is not only enhancing scalability but also dramatically reducing transaction costs, enabling broader adoption by developers and users alike. This trend signals a maturation of Ethereum’s network that positions it strongly for long-term growth.

Market Context and Background

Ethereum’s journey to dominance has evolved from simply being the leading smart contract platform to becoming the backbone of decentralized finance (DeFi) and non-fungible tokens (NFTs). However, scaling issues have long plagued the Ethereum mainnet, with high gas fees and network congestion creating bottlenecks for mass adoption.

Layer-2 solutions, such as rollups, Plasma, and state channels, emerged as critical innovations to alleviate these scalability bottlenecks. By processing transactions off-chain or in batches, Layer-2 solutions maintain Ethereum’s security model while increasing throughput and lowering fees.

February 2026 saw wide interest in several key Layer-2 projects, propelled by Ethereum’s recent Pectra and Fusaka upgrades. These upgrades notably increased blob transaction capacity and improved network efficiency, catalyzing Layer-2 ecosystem expansion.

Data-Driven Insights

Recent data underscores Ethereum’s resilience. Despite a volatile market, Ethereum maintained a trend score of 95/100 and daily trading volume exceeding $49 billion. The network’s total market capitalization rose to approximately $360 billion post-upgrades.

Layer-2 solutions now process over 60% of Ethereum’s transaction volume, a testament to their growing adoption. Popular scaling solutions, including Optimism and Arbitrum, have recorded massive increases in user counts and total value locked (TVL), with Optimism’s TVL surpassing $2 billion and Arbitrum nearing $3 billion.

DeFi activity has also been a major demand driver. Platforms like Aave, Uniswap, and Curve continue to report high volumes, leveraging Layer-2 for enhanced user experience. The increase in blob transaction capacity introduced by Fusaka upgrade has enabled complex DeFi operations at a fraction of prior costs.

Risks and Opportunities

Risks:

- Competition from emerging Layer-1 blockchains with alternative scaling paradigms could reduce Ethereum’s market share.

- Regulatory uncertainties remain a concern, potentially affecting both Ethereum and Layer-2 projects.

- Technical challenges in cross-layer interoperability and security could impact user confidence.

Opportunities:

- Continued Layer-2 innovation promises exponential increases in throughput and user adoption.

- Growing institutional DeFi composability on Ethereum’s Layer-2 can unlock new financial products.

- Network upgrades like Fusaka and upcoming blade upgrades reinforce Ethereum’s technological leadership.

Future Outlook

Ethereum’s Layer-2 ecosystem is projected to expand robustly throughout 2026 and beyond. As developers optimize dApps for Layer-2 compatibility and users seek cost-effective transactions, Ethereum’s network is set to capture increasing market segments.

Institutional interest is also expected to rise, driven by Layer-2’s enhanced scalability and maturity. The integration of Layer-2 solutions with Ethereum 2.0’s shard chains and consensus improvements could catalyze a new era of scalable, secure blockchain applications.

Overall, the future of Ethereum Layer-2 looks promising with sustained network upgrades, growing DeFi ecosystems, and heightened user engagement paving the way for long-term value growth.

Conclusion

Ethereum’s ability to maintain dominance amidst market weakness highlights the critical importance of Layer-2 technology in the broader crypto ecosystem. The network’s recent upgrades and Layer-2 expansion are key drivers that continue to attract diverse market participants, from retail traders to institutional investors.

As Ethereum advances its scalability roadmap and Layer-2 solutions mature, it is poised to solidify its position as the foundational platform for decentralized finance and smart contract applications worldwide.